Section 132(f) of federal tax law allows employees to pay for transit and parking costs using pre-tax dollars. By using pre-tax dollars, employees can save up to 40% annually on their commuting costs while also reducing your company’s payroll taxes.

Behind the benefitsEmployers can sign up to enroll and begin offering this benefit to employees.

RTA staff can answer any questions about the process or provide support.

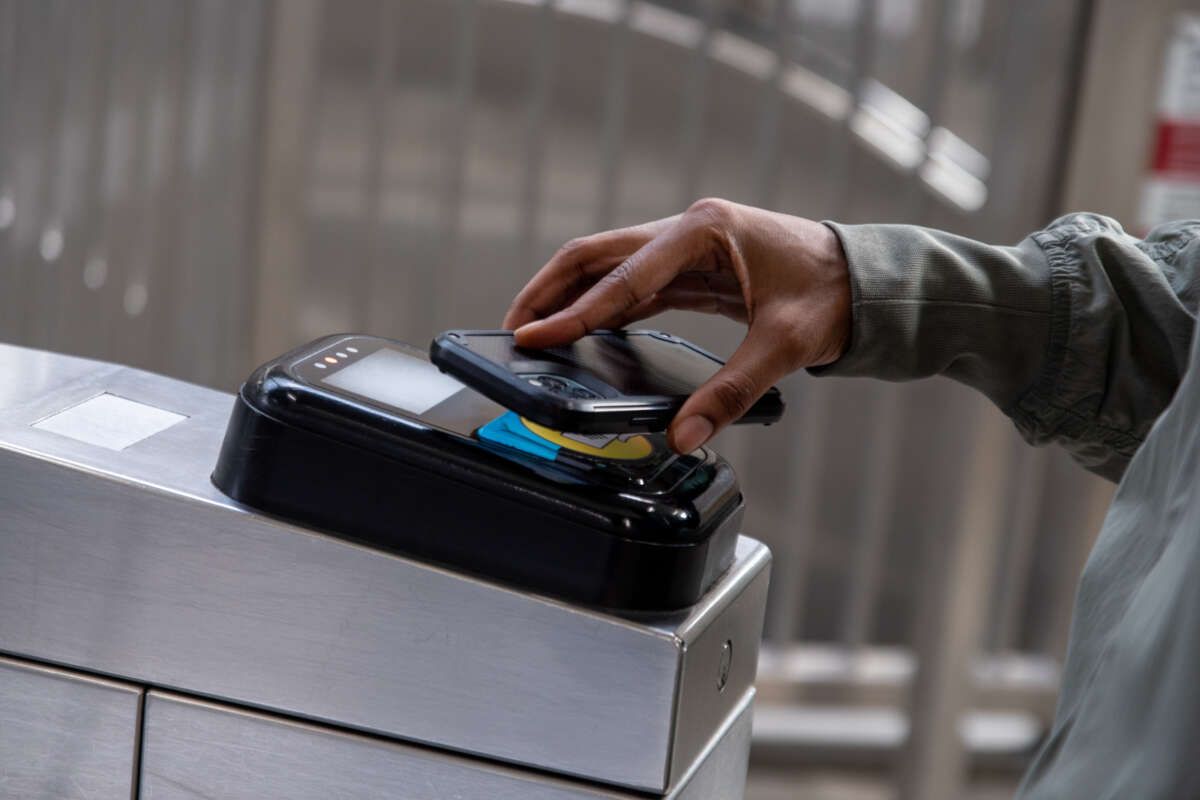

Participants in the program can take advantage of various products with their pre-tax benefit.

The program allows any size company to add to the benefits package.

Want to offer your employees a benefit that encourages them to come into the office, helps the environment, and saves both you and them money?

The RTA Transit Benefit Fare Program allows your employees to set aside pre-tax income, up to $325 each month.

Learn MoreParticipating in the RTA Transit Fare Benefit Program saves you money and time on your commute.

Set aside pre-tax money for transit and parking costs to make your travel to work easier and less expensive. If your employer doesn’t offer a transit benefit fare program, encourage them to enroll today.

Learn More Legislation expands Transit Benefit Program to workplaces across the Chicago region

Legislation expands Transit Benefit Program to workplaces across the Chicago region

Legislative action in Springfield will expand the pre-tax transit benefit program to places of business across the Chicago region, offering both employees and employers tax savings...

Learn More Transit Benefit Fare Program adds parking option to increase flexibility as riders return

Transit Benefit Fare Program adds parking option to increase flexibility as riders return

To adapt to the changing needs of riders, the RTA is announcing the addition of pre-tax parking benefits as a new product option in its Transit Benefit Fare Program....

Learn MoreWant to know more about how our program can benefit you? Send us a message, and we'll guide you through the process.

Currently enrolled Employers/Employees, please contact our customer service team at 888-782-1008 or help@mytransitbenefit.com.